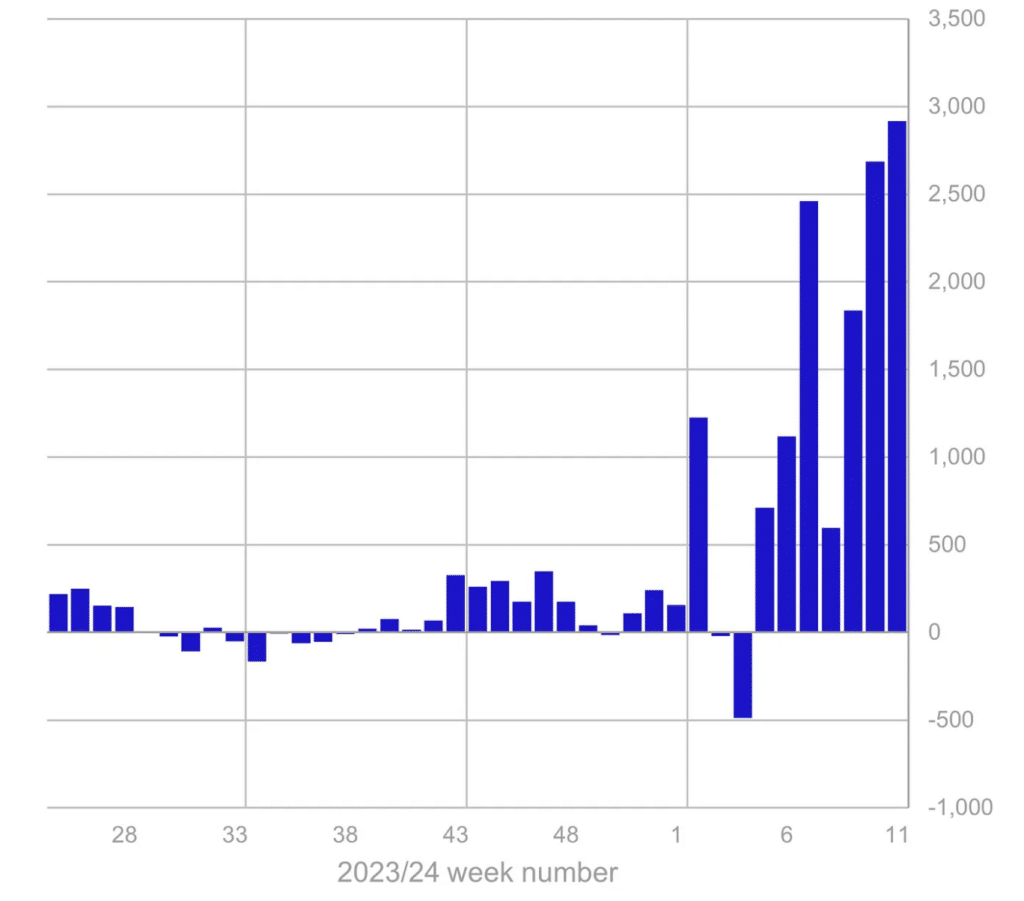

Crypto fund inflows hit new record, reaching $2.9b in week

Investment products based on digital assets attracted $2.9 billion in the week from March 11 to March 15.

According to a report from CoinShares, capital inflows broke the previously set record of $2.7 billion. The latest week’s inflows take year-to-date inflows to $13.2 billion, topping 2021 total inflows of $10.6 billion.

At the same time, trading volumes for the week amounted to $43 billion – this is a record for the previous week and more than 47% of the total global volumes of Bitcoin (BTC). Blockchain shares inflowed $19 million for the first time after six weeks of outflows.

During the week, global ETPs crossed the $100 billion mark for the first time, although a price correction later saw them settle at $97 billion.

Bitcoin inflows totaled $2.86 billion last week, accounting for 97% of all year-to-date inflows. At the same time, short Bitcoin inflows for the year totaled $26 million, the fifth week in a row. The leading altcoins are experiencing capital outflows – Ethereum (ETH), Solana (SOL), and Polygon (MATIC) lost $14 million, $2.7 million, and $6.8 million, respectively.

A week earlier, from March 4 to March 8, 2024, capital inflows into crypto investment products reached a record level of $2.7 billion. Over the past two-plus months, the total inflow amounted to $10.3 billion. For comparison, experts noted that for 2021, this figure amounted to $10.6 billion. The first cryptocurrency played a vital role in the increase in volume. Bitcoin accounted for $2.6 billion.

Leave a Reply