Bitcoin price is beating risky leveraged ETFs like BITX and BITU

Bitcoin price is outperforming popular leveraged ETFs, which have become increasingly popular among investors.

Leveraged Bitcoin ETFs inflow is rising

Leveraged Bitcoin ETFs like the 2x Bitcoin Strategy ETF (BITX) and the ProShares Ultra Bitcoin ETF (BITU) are seeing inflows this year. Data by ETF.com shows that the BITX ETF has added assets in all months this year. As a result, its total assets under management have risen to over $1.39 billion.

BITU, launched in April, has already added $266 million in assets, indicating strong demand among investors. This week, the T-REX 2X Bitcoin Daily ETF was also launched.

These funds aim to achieve better returns by generating a result that corresponds to two times the return of Bitcoin in a day. For instance, if Bitcoin rises by 1% in a day, the fund’s stock will rise by 2%.

Historically, leveraged funds perform better than the underlying asset if its price rises. For example, the ProShares UltraPro QQQ ETF (TQQQ), which generates two times the daily return of the Nasdaq 100 index, has risen by 2,300% in the past decade. The Nasdaq 100 index has risen by 420% in the same period.

Therefore, BITX and BITU aim to replicate that performance since Bitcoin has been in a long-term bull market since its inception.

Bitcoin is beating BITX and BITU

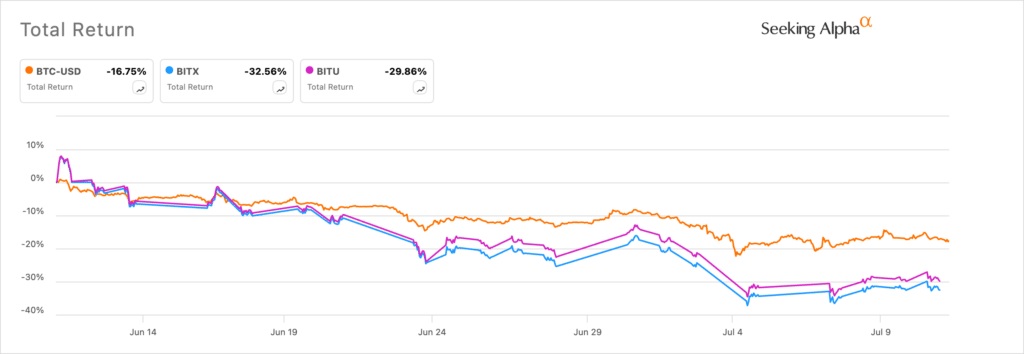

BTC vs BITU VS BITU

Data shows that Bitcoin is outperforming BITX and BITU this year. It has risen by 27%, while the BITX ETF is up 25.8%. Similarly, in the past month, Bitcoin has dropped 17%, while BITX and BITU are down 32% and 29%, respectively.

Leveraged ETFs come with significant risks. First, they can be expensive to own. BITX has an expense ratio of 1.9%, while BITU charges 0.95%. Thus, $10,000 invested in the BITX fund will attract an annual fee of $190, which is substantial and can compound into thousands of dollars for long-term investors.

Second, Bitcoin goes through periods of booms and busts. For example, it peaked at $19,906 in 2017, then tumbled to a low of $3,245 in 2019 before bouncing back. It then peaked at $68,987 in 2021, and fell to $15,590 in December 2022.

While such drawdowns are painful for Bitcoin holders, they are worse for leveraged Bitcoin holders. For instance, the TQQQ ETF suffered an 80% drop in 2022 when the Nasdaq 100 index fell by 32%.

Leave a Reply