Ten, including two bank managers, charged in KK over RM24.2mil bank fraud

KOTA KINABALU: Ten people, including two bank managers, have been charged at the Kota Kinabalu Sessions Court here for being members of an organised crime group linked to missing funds totalling RM24.2mil from several bank accounts.

The accused are Josepin J. Langkan, Mazlani Jenuary, Hasran Magin, Leong Hin Ping, Subramaniam Thangavelu, Sugumaran K. Ponniah @ Mohd Daniel Abdullah, Vireonis Jonok, Iren Chin Nyuk Thien, Christina @ Caroline Pianus, and Nasir Abdul Rashid.

The suspects, aged between 37 and 62 years old, were brought before Sessions Court Judge Amir Shah Amir Hassan, where they were charged under Section 130V(1) of the Penal Code.

No pleas were taken pending the next mention date, set for Sept 13. Their pleas will only be recorded at the High Court after motions have been filed by the defence lawyers.

Earlier, Deputy Public Prosecutor (DPP) Lina Hanini Ismail offered no bail and requested another mention date two months from now. Defence lawyers pleaded for an earlier mention date.

The prosecution stated that the two-month period is necessary to gather more evidence and complete other tasks.

Judge Amir inquired if there were any security reasons involved, to which the DPP responded affirmatively, citing the charge under the Security Offences (Special Measures) Act (Sosma).

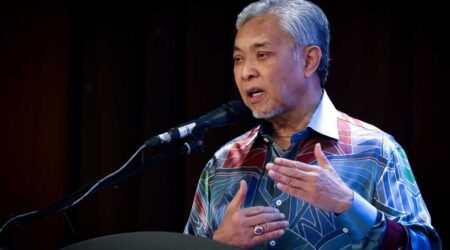

On July 23, Bukit Aman Commercial Crime Investigation Department (CCID) director Comm Datuk Seri Ramli Mohamed Yoosuf said police had previously detained 14 suspects aged between 26 and 63 under Section 4(5) of Sosma 2012.

On Monday (July 22), the DPP instructed charges against nine suspects under Section 130V(1) of the Penal Code for being members of an organised crime group, and one other under the National Registration Regulations 1990.

Among those charged are the ringleader and a bank manager involved in the crime, Comm Ramli said.

He believes the suspects created fake MyKad to manipulate the bank’s fingerprint scanner and fraudulently withdraw funds.

The syndicate’s activities are expected to be curtailed with the charging of the 10 individuals, he said.

Comm Ramli previously mentioned that the suspects embezzled millions from the bank by targeting high-value account holders, identified by insiders within the syndicate.

The stolen funds were withdrawn via bank counter transactions, starting in April and continuing through May and June. The case came to light after a targeted account holder sought to update their details at the bank.

Leave a Reply