Bank managers, teacher among 10 facing trial for alleged involvement in RM24.2mil embezzlement case

KOTA KINABALU: Ten people, including two bank managers and a teacher, have claimed trial for being members of an organised crime group linked to missing funds totalling RM24.2mil from several bank accounts.

They pleaded not guilty before judge Datuk Zaleha Rose Pandin after their cases were transferred from the Kota Kinabalu Sessions Court to the High Court, Friday (Sept 13).

They were first charged at the Sessions Court here on July 25.

The 10 were bank managers Iren Chin Nyuk Thien, 38 and Christina @ Caroline Pianus Etip, 53; contractor Josepin J. Langkan, 38; teacher Subramaniam Thangavelu, 56; pensioners Nasir Abdul Rasid, 60 and Leong Hin Ping, 62; self-employed Sugumaran K. Ponniah; 56, fisherman Hasran Magin, 46 and two unemployed Vireonis Jonok, 35 and Mazlani Jenuary, 53.

The accused, believed to have been led by Josepin, was charged with being members of an organised crime group involved in serious offences for the material benefit of the group under Section 130V(1) of the Penal Code, which carries a jail term of between five years and 20 years upon conviction.

Zaleha fixed Nov 7 for further mention.

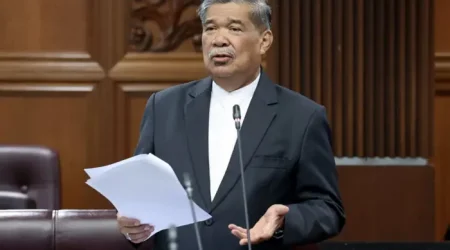

Previously July 23, Bukit Aman Commercial Crime Investigation Department (CCID) director Comm Datuk Seri Ramli Mohamed Yoosuf said police had detained 14 suspects aged 26 to 63 under Section 4(5) of the Security Offences (Special Measures) Act (Sosma) 2012.

They believe the suspects made a detailed plan to produce fake MyKad (for use in banking matters) and manipulate the bank’s fingerprint scanner.

He said they believed the syndicate’s activities would be successfully stopped with the charging of the 10 individuals.

Comm Ramli had previously said the suspects linked to the embezzlement of millions from a bank targeted their victims after syndicate members on the inside identified high-value account holders.

He said the monies were taken out via bank counter transactions, the first being conducted around April. Several more were done in May and June.

Via inside help, the money was taken out according to bank procedures. The case only came to light after a targeted account holder went to the bank to update their details, he said.

Leave a Reply