Ipoh couple claims money in FD transferred out without their knowledge

IPOH: An aquarium shop owner and her husband were shocked to find out that RM23,080 from their fixed deposit accounts had been transferred out without their knowledge or consent.

Ling Yoke Suan, 36, said that on Sept 9, about 17 transactions were made to six other bank accounts.

“This happened at around 4:45 am. I lost RM18,480, and my husband, Yong Kui Hin, 38, lost about RM4,600 in just two hours.

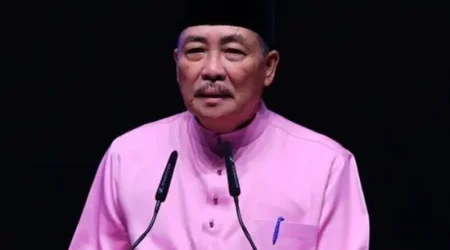

“We only discovered the loss after receiving a call from the bank at 8:42 am, informing them that both our fixed deposit accounts had been suspended due to suspicious account transactions,” she said at a press conference organised by Perak MCA Public Services and Complaints Bureau Chief Yuen Chan How on Thursday (Oct 3).

“We had two fixed deposits for our children’s education in that bank, and that money was transferred to other parties. We had never used the money for any purpose as we were saving up for the children’s education,” said Ling, who added she was unsure whether it was stolen by hackers or if there was an internal issue with the bank, adding that she and her husband did not receive any one-time passwords (OTP) for the transactions, and had not clicked on any suspicious links.

“The bank told us that the transactions were done according to the proper procedure, as a device bind took place on Sept 8.

“Both our online login IDs, passwords, and security questions were verified. Due to this, the bank says they are not responsible for the losses and will not offer any compensation,” she added.

Ling and her husband have since gone to Bank Negara Malaysia and were referred to the Ombudsman for Financial Services (OFS) for further assistance.

Yong added that he hopes to get a clarification on the transactions that were done without their consent.

“We hope to get a clarification from the bank on these transactions made.

“We also hope that the person behind this will be caught and investigated,” he said.

Meanwhile, Yuen said the police have opened an investigation under Section 420 of the Penal Code for cheating.

He urged the authorities to investigate the bank accounts that received the money to determine if they were opened legally or with the intention of committing fraud.

“We need to find out who is behind this as there may be more innocent people affected by it,” he said.

Leave a Reply