Singapore Cold Storage, Giant customers can expect cheaper products, more variety after takeover, Malaysian buyer says

SINGAPORE: Customers of Cold Storage and Giant can expect more value for money, a greater variety of merchandise and new outlets following the sale of the supermarket chains to Malaysian retail group Macrovalue.

DFI Retail Group, which owns Cold Storage and Giant in Singapore, on March 24 announced that it will sell all 48 Cold Storage and 41 Giant outlets, as well as two distribution centres, to Macrovalue for S$125 million (US$93.38 million). The brands under Cold Storage include CS Fresh, CS Gold and Jason’s Deli.

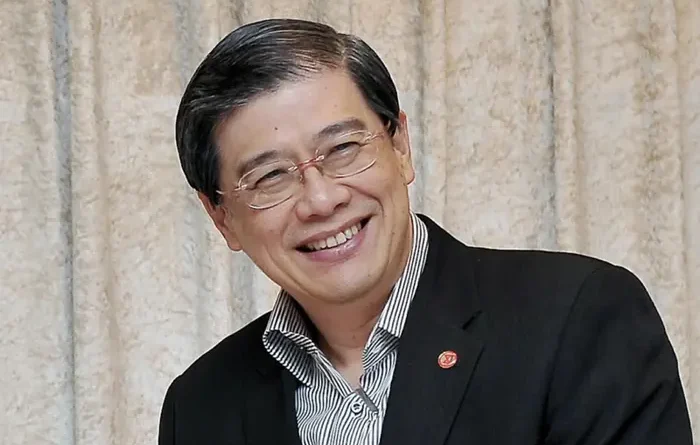

Speaking to The Straits Times shortly after the deal was made public, Macrovalue owner Andrew Lim Tatt Keong (pic) said customers of Cold Storage, which targets a more upscale clientele, can soon expect a wider range of merchandise, including “special items the other supermarkets don’t have”.

“We’ll be able to offer a greater variety of merchandise at Cold Storage, such as wines, cheese and dairy products that are currently also retailing at our upscale Mercato supermarkets in Malaysia.”

Giant’s more mainstream customers will enjoy better prices on basic products that are imported from Malaysia, such as eggs, chicken, fruit and vegetables, as well as other household items.

“We have a whole logistics and supply chain in Malaysia that we can tap on to benefit Singapore customers and give them more value for money,” Lim said.

Consumers in Singapore could see new Giant and Cold Storage outlets opening up in new locations across the island over the next one year as Macrovalue focuses on stabilising the business while ensuring it stays profitable.

“We’ll work on adding value through variety, price and customer experience within a year, as the market would be expecting it,” Lim said.

He added that one of the first things Macrovalue did after finalising the transaction was to meet landlords and those who own the properties that the supermarkets occupy.

“We did a meet-and-greet with landlords like CapitaLand to introduce ourselves as we’ll need to work with them on renovations, expansion and future store openings,” Lim said.

“We also want to continue our tenancies for the different outlets, and need to listen to the landlords to understand their expectations on a case-by-case basis.”

Lim noted that the S$125 million he is paying comprises the value of the Giant and Cold Storage brands and business, and does not include any properties.

“We are just buying the business, including the tenancies and leases, as DFI does not own any property in Singapore,” he said.

“The amount we are paying fully reflects the value of the business, and the price is reasonable and rational,” Lim said, adding that Macrovalue will not inherit any debt or other liabilities from the acquisition.

He conceded that the final price tag of S$125 million involved “hard negotiations”, given that the deal also comes after DFI’s supermarket operations in Singapore became profitable in 2024 following several years of losses.

Still, DFI’s chief executive Scott Price revealed during the company’s results briefing on March 10 that despite returning to the black, DFI expects its supermarket revenue in Singapore to remain stable at best amid heavy competition.

In Singapore, Giant and Cold Storage compete with FairPrice, which has 164 stores, and Sheng Siong with 77 outlets.

DBS analyst Andy Sim noted that while revenue for the Singapore supermarket business amounted to around S$1 billion (US$0.75 billion) in 2024, the business was still loss-making in the first three quarters of the year before turning profitable in the fourth quarter.

DFI does not provide a revenue or profit breakdown for the Singapore business.

“From a bottom-line basis, the Singapore supermarkets business is suboptimal compared with the health and beauty and convenience segments, which have better margins,” he said.

MSim said DFI’s decision to sell the Giant and Cold Storage supermarkets in Singapore is “very consistent” with the strategy of the CEO, Price, which prioritises total shareholder returns and return of capital employed.

Following the sale of the supermarkets, the group will focus on growing its Guardian and 7- Eleven businesses in Singapore to drive further growth.

The transaction is expected to be completed in the second half of 2025.

The sale also comes after DFI in 2023 sold its supermarket businesses in Malaysia – comprising Giant, Cold Storage and Mercato stores – to Macrovalue. It later sold the Indonesia supermarket business to another buyer in 2024.

Lim told ST that the acquisition of Giant and Cold Storage in Singapore will enable Macrovalue to scale and expand its supermarket empire and build a long-term, sustainable business by “bringing the brands together”.

“Cold Storage, in particular, has a long history here and Singaporeans are enamoured of the brand,” Lim said.

Macrovalue was set up in 2022 by Lim and Datuk Gary Yap Keng Fatt, both of whom are veterans in the retail industry.

Lim is also group deputy chairman of Sogo Department Store in Kuala Lumpur, as well as the executive chairman of the Gama Group, which owns and operates Gama Supermarket & Departmental Store in Penang.

DFI, then known as Dairy Farm, bought Singapore’s Cold Storage with a network of 142 stores in 1993. In 2003, it bought 35 Shop N Save supermarkets, which were later converted to Giant supermarkets in 2013. – The Straits Times/ANN

Leave a Reply