Bank Negara cuts OPR to 2.75% in first rate move since May 2023

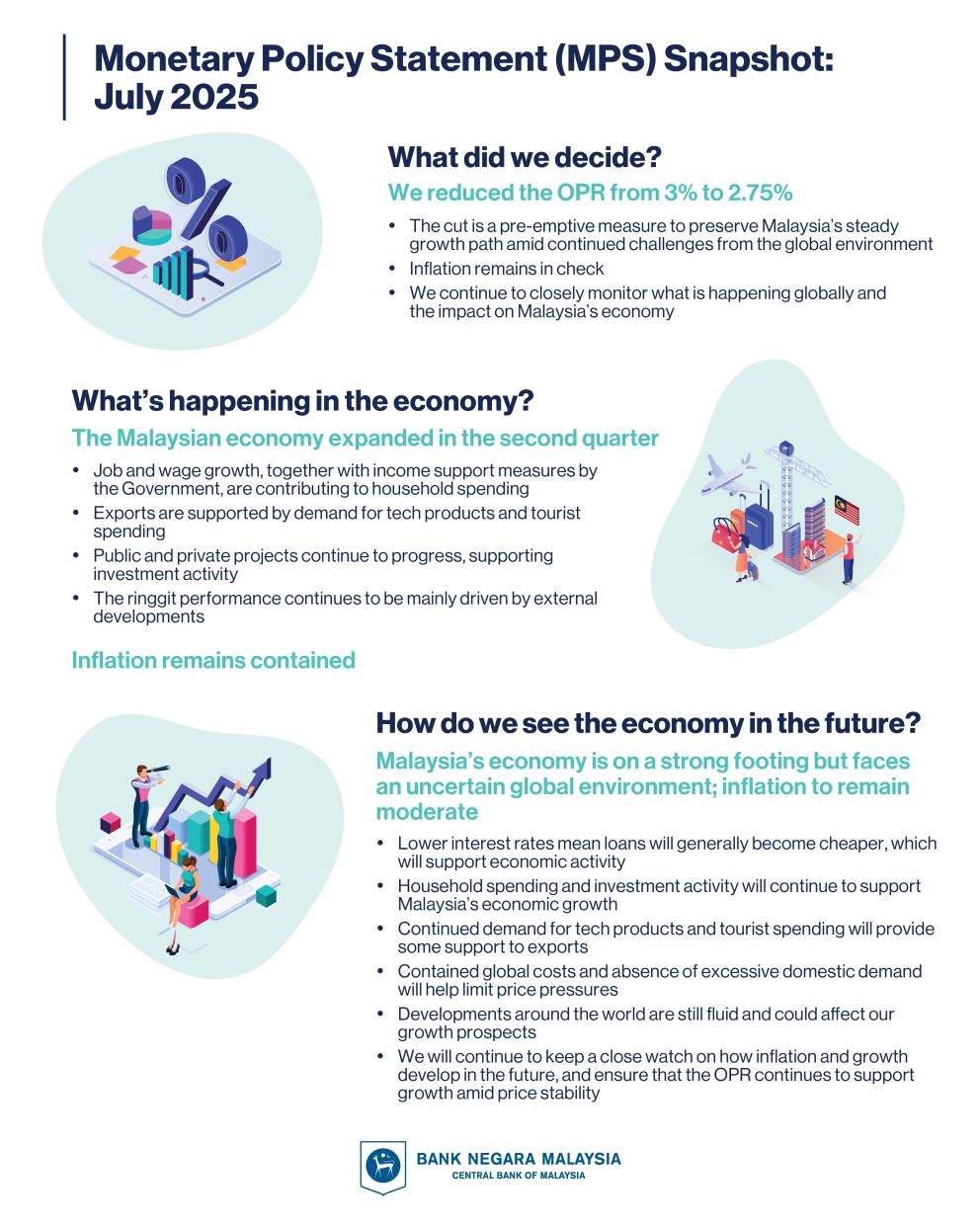

KUALA LUMPUR: Bank Negara has cut the Overnight Policy Rate (OPR) by 25 basis points to 2.75% at its July Monetary Policy Committee (MPC) meeting, marking the first rate adjustment since May 2023.

The latest move by Bank Negara was broadly in line with market expectations, following a Bloomberg poll that showed economists were split, with 12 out of 23 forecasting a cut, while the rest expected no change.

While domestic inflation remains contained, the outlook is clouded by rising external uncertainties such as tariff actions and geopolitical tensions.

The central bank, in a statement, said the ceiling and floor rates of the corridor of the OPR are correspondingly reduced to 3% and 2.5% respectively.

Bank Negara noted that while the domestic economy is on a strong footing, uncertainties surrounding external developments could affect Malaysia’s growth prospects.

“The reduction in the OPR is, therefore, a pre-emptive measure aimed at preserving Malaysia’s steady growth path amid moderate inflation prospects.

“The MPC will continue to remain vigilant to ongoing developments and assess the balance of risks surrounding the outlook for domestic growth and inflation,” the central bank said.

Bank Negara said the latest indicators point to continued global growth, supported by resilient consumer spending, front-loading activity, strong labour markets, easing monetary policy, and fiscal stimulus.

“This outlook is weighed down by uncertainties surrounding tariff developments, as well as geopolitical tensions. Such uncertainties could also lead to greater volatility in the global financial markets and commodity prices,” it said.

For Malaysia, Bank Negara said the latest developments point towards continued growth in economic activity in the second quarter, underpinned by sustained domestic demand and export growth.

Moving forward, growth is expected to be driven by resilient domestic demand, supported by employment and wage gains in domestic-oriented sectors and income-related policy measures that will bolster household spending.

Bank Negara noted that the expansion in investment activity will be sustained by the progress of multi-year projects in both the private and public sectors, the continued high realisation of approved investments, as well as the ongoing implementation of catalytic initiatives under the national master plans.

“Favourable trade negotiation outcomes, pro-growth policies in major economies, continued demand for electrical and electronic goods, and robust tourism activity could raise Malaysia’s export prospects.

“However, the balance of risks to the growth outlook remains tilted to the downside, stemming mainly from a slower global trade, weaker sentiment, as well as lower-than-expected commodity production,” the central bank said.

Headline and core inflation averaged 1.4% and 1.9% respectively in the first five months of the year.

“Overall, inflation in 2025 is expected to remain moderate, amid contained global cost conditions and the absence of excessive domestic demand pressures,” it said, adding that inflationary pressure from global commodity prices is expected to remain limited, contributing to moderate domestic cost conditions.

Meanwhile, Bank Negara said the ringgit’s performance will continue to be primarily driven by external factors.

“Malaysia’s favourable economic prospects and domestic structural reforms, complemented by ongoing initiatives to encourage flows, will continue to provide enduring support to the ringgit,” it said.

Leave a Reply