Bitcoin poised for green July, according to history

Bitcoin’s historical data suggests July is a positive month for BTC holders. This bodes well after the asset lost nearly 10% of its value last month.

Bitcoin (BTC) reclaimed the $62,200 level and approached $63,000 on Monday after a 2% bounce for the largest cryptocurrency on the market. CoinGlass data also showed that BTC’s move propelled it above a $43 million liquidity wall, setting BTC up for what may be a green month if history repeats itself.

In previous years, an average Bitcoin increase of almost 8% in July followed a red candle close in June. BTC shed value on six occasions in June between 2013 and 2024, but the asset boomed by at least 9.6% in July during these six years.

As crypto.news reported, the thesis is backed by fatigued sell-offs from BTC miners. Mining entities previously capitulated and liquidated swathes of BTC to cover operations costs following the halving. But this pattern has slowed down heading into the new month.

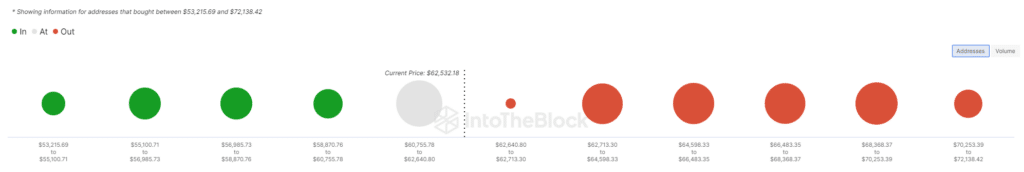

Bitcoin support and resistance points

According to data from Glassnode and IntoTheBlock, BTC established support around the $60,500 to $61,600 mare. Some two million addresses accumulated more than 891,800 BTC worth $55.7 billion. It’s unlikely that crypto falls below this level, although it’s not impossible.

At the same time, two major resistance walls at $64,700 and $64,550 may stand between Bitcoin and a short-term blitz back to the $70,000 range.

Macro events to look out for

Per Lucy Gazmararian, the correlation between BTC and macroeconomic events may strengthen due to inflationary periods and geopolitical uncertainty. Considering ongoing global inflation, particularly in the U.S., and tensions in Eastern Europe and the Middle East, macro events could have a greater impact on BTC markets.

Federal Reserve chairman Jeremy Powell is scheduled to speak on July 2, followed by the Federal Open Market Committee (FOMC) minutes on July 3 and U.S. Jobs data on July 5. Positive news from all three events may bolster Bitcoin’s bullish momentum this month or stall the asset.

Leave a Reply