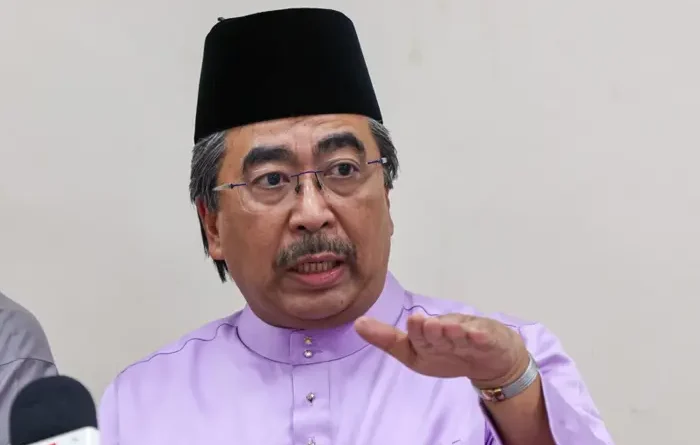

Country records RM3 trillion trade, 28th year in trade surplus, says Miti minister

KUALA LUMPUR: Despite trade challenges threatening Malaysian exports, the country has recorded its highest-ever trade value of RM3.06 trillion, says International Trade and Industries (Miti) Minister Datuk Seri Johari Ghani. He said this is the 28th year Malaysia has had a trade surplus. He added that the country’s trade is expected to grow further between 3% and...