Top Glove Chairman Tan Sri Dr Lim Wee Chai Lost RM200 Million

As a shareholder, your fortune often relies on the performance of your stocks in the market. While unpredictable factors may boost your shares, it has equal chances of dropping them as well.

The founder and executive chairman of Top Glove, Tan Sri Dr Lim Wee Chai, has been experiencing a loss due to the collapse of Top Glove stock prices. Currently, it is roughly estimated that the stocks held by him and his family have lost about RM200 million since Top Glove’s stock price peak.

According to Bursa Malaysia, as reported by China Press, Lim and his family directly and indirectly hold 35.44% (2,836,223,804 shares) of Top Glove. Lim became one of the top 500 richest people in the world when Top Glove’s stock price was at a 52-week high (RM9.72). His total holdings amounted to RM27,568,095,375 during that period.

At the peak of Top Glove’s stock price, the market value was as high as RM78.6 billion. It not only surpassed Public Bank (PBBANK, 1295), a main financial service, it also threatened the status of Maybank (MAYBANK, 1155)’s annual market value in the Malaysian stock market.

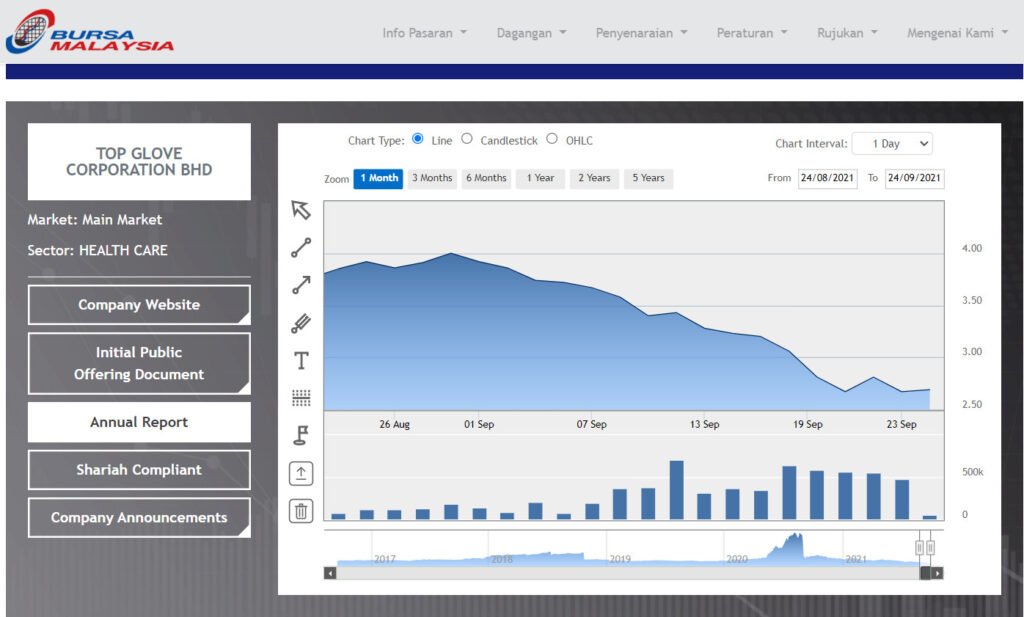

Although Top Glove is still in the top 30 stock market index, its market value has fallen to the RM20 billion level. In comparison to its peak period, its decline is as high as 70%. The decline follows the normalisation of the demand for gloves which heightened during the pandemic. The year-long ban on their products in the U.S. due to allegation of forced labour at its factories has not helped matters.

The ban has been lifted last week however. While the stock prices of Top Glove rebounded slightly to RM2.81 on 22nd September, major brokerages have slashed their target prices due to negative market outlook. As a result, the stock price fell again on 24th September. Additionally, this has caused Lim’s total shareholding value to plummet to RM7.6 million, which left him a full loss of RM199 million.

Maybank Investment Bank Bhd (Maybank IB) lowered its target price for Top Gloves to RM1.68 on Wednesday (22nd September). This has caused on uproar in the market. Target prices of the remaining investment banks are around RM2.60 and RM2.84. It is believed the profitability of Top Glove looks bearish in 2022 and 2023.

Lim founded Top Glove in 1991 with his wife Tong Siew Bee and made the company public in 2001. They roughly manufacture around 100 billion gloves a year and are one of the world’s largest rubber gloves manufacturers.

Lim was ranked No. 8 on Malaysia’s 50 Richest published in June as he had a net worth of $3.5B. However, according to Forbes, his real time net worth is now $1.9B.

Sources: China Press, Forbes (1)(2), Bursa Malaysia

Leave a Reply