Tycoon who gave away US$750mil sees profit in loans to the poor

HE built a fortune lending to low-income borrowers shunned by banks. He paid staff below-market wages and thought they still earned too much. He gave away almost all his wealth to a handful of employees, content with his small house and a US$5,000 car.

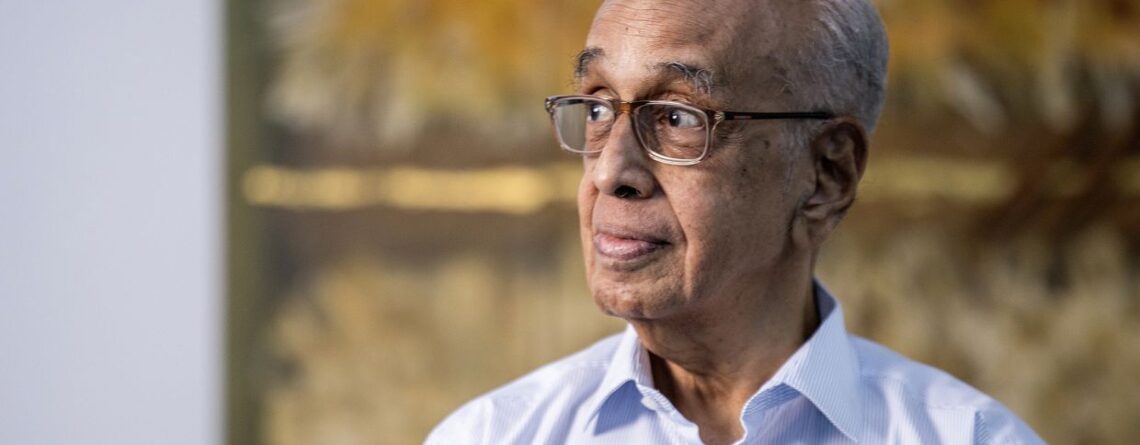

R Thyagarajan is arguably one of the world’s most idiosyncratic financiers – in no small part because his multi-billion-dollar business, the Shriram Group, has thrived in an industry that tripped up countless others around the globe.

A pioneer in extending credit to India’s poor for trucks, tractors and other vehicles, Thyagarajan built Shriram into a conglomerate that employs 108,000 people in everything from insurance to stockbroking.

Shares of the group’s flagship firm hit a record in July after jumping more than 35% this year, four times more than India’s benchmark stock index.

Now 86, and settled into an advisory role, Thyagarajan said in a rare interview with Bloomberg News that he entered the industry to prove lending to people without credit histories or regular incomes isn’t as risky as it’s perceived.

He insists there’s nothing unusual about his approach to business – or his decision to give away a stake in Shriram now valued at more than US$750mil.

“I’m a bit of a leftist,” RT, as he’s known, said in the south Indian city of Chennai, where he founded the group in 1974.

“I was never enthusiastic about making life pleasanter for people who already have a good life.” Rather, I “wanted to take away some unpleasantness in the lives of people who are getting into problems.”

Thyagarajan’s career highlights untapped opportunities in the world’s most populous country, as more of its 1.4 billion people strive to enter a growing middle class.

Though Prime Minister Narendra Modi’s government has pushed to expand access to India’s banking services, about a quarter of the nation still doesn’t have access to the formal financial system.

And roughly a third of those who do have a bank account never use it, according to the World Bank.

Lending to the poor is a form of socialism, Thyagarajan contends. But by offering a cheaper option than the punitive rates available to the unbanked, he has sought to demonstrate that the business can be safe and profitable. And in doing so, he’s persuaded other companies to bring down borrowing costs.

Now, the industry is big business. India has about 9,400 so-called shadow banks, which mostly offer financial services to people passed over by conventional lenders.

“RT is an outlier,” said Srinivas Balasubramanian, senior partner and head of corporate finance at KPMG India. “Few have sustained and thrived for so long.”

Indeed, Thyagarajan stands out in an industry that has been plagued by ethical challenges and is prone to booms and busts – with blowups sometimes threatening the financial system.

The most obvious example is the subprime mortgage crisis in the United States. More recently, the collapse of a non-bank lender in Mexico last year wiped out billions for investors.

Forging a socialism-inspired lending firm might seem an unexpected career choice for a man who grew up surrounded by servants in a well-to-do farming family in the state of Tamil Nadu. But Thyagarajan said he’s always had an analytical and egalitarian-oriented mind.

He studied mathematics at the undergraduate and master’s level in Chennai before spending three years at the prestigious Indian Statistical Institute in Kolkata.

In 1961, he joined New India Assurance Co, one of India’s largest insurers, starting a spell in finance as a company employee that lasted two decades. It included stints at Vysya Bank, a regional lender, and JB Boda & Co, a reinsurance broker.

Along the way, people in Chennai came to him seeking money to buy used trucks, and he gave them loans from his inheritance.

Gradually, that side venture morphed into his life’s main act. At 37, he founded Shriram Chits with friends and relatives.

The unbanked often rely on so-called chit funds, a collective savings scheme where each member deposits a fixed amount every month. The pot is doled out to one investor a month until everyone has received a share. The money is used for farm equipment, school fees or other large purchases.

Over the years, Thyagarajan set up other firms, and Shriram eventually grew into a group of more than 30 companies.

In truck financing, Thyagarajan saw people paying rates as steep as 80% because banks wouldn’t deal with them. He concluded that the prevailing thinking was wrong.

“People used to think that because the interest rates were very high, the lending was very risky,” he said. “I realised it was not risky at all.”

This epiphany would define his life. He decided to lend at rates that were still extremely high by global standards, but lower than other options.

“Interest rates went from 30% and 35% to 17% and 18%,” he said.

Thyagarajan said his approach wasn’t about charity. It was infused with two key capitalist beliefs. One was the importance of private-sector entrepreneurship; the other, faith in market principles.

That ethos has paid dividends: Shriram collects more than 98% of dues on time, filings show. It gets its lending decisions right, the local unit of S&P Ratings said.

More broadly, non-bank financiers like Shriram are crucial for supporting India’s newly banked.

They underwrite loans and other products that require skill-sets banks often don’t have, according to Bindu Ananth, co-founder of Dvara Holdings, which backs companies driving financial inclusion. — Bloomberg

Anto Antony writes for Bloomberg. The views expressed here are the writer’s own.

Leave a Reply