Man speaks of months-long ordeal after contacting illegal moneylenders

JOHOR BARU: A man who had lent his younger sister RM30,000 ended up experiencing financial trouble himself after he turned to an illegal money lender for help.

This led to months of daily harassment from loan sharks for the 41-year-old Ku, who lost his job in Singapore and saw his house in his hometown set on fire.

Ku said he came across a Singapore-based online loan advertisement in April and decided to click on it as he hoped to borrow S$1,000 (RM3,482) due to financial difficulties.

He added that he was convinced by the advertised low interest rate and long installment payment period.

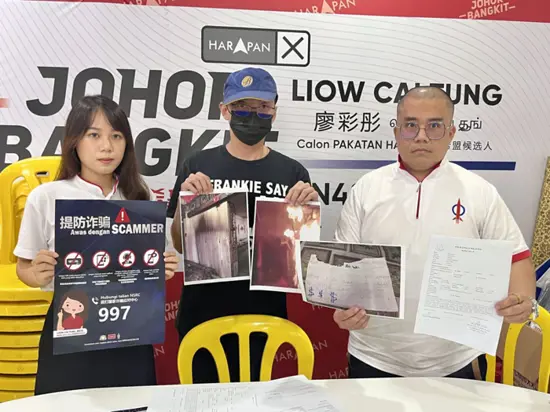

He told a press conference organised by Johor Jaya DAP public complaints head Michael Mok here on Wednesday (July 17) that he refused to go ahead with the loan when he found out that they were illegal moneylenders.

“However, Simon insisted by saying that he had my personal particulars and could harm me if they wanted to,” said Ku, who was was working as an operations manager at a three-star hotel at the time.

Ku added that he was told to repay S$400 (RM1,393) within a week including interest, which he did and said that on May 1, another man called Tony contacted him and offered to lend him S$500 (RM1,741).

“I do not know him yet he had all my personal particulars and he threatened to cause harm if I refused his offer. I reluctantly agreed and followed his instructions to repay S$680 with interest in the following week,” said Ku.

“I thought my nightmare would have been over by then but Tony said I deposited the money wrongly into his Singapore bank account, causing it to be suspended,” he added.

According to Ku, Tony demanded S$11,000 (RM38,296) from him as a payment to the bank to un-suspend the bank account.

At his wits end, Ku sought help from Simon to deal with Tony, in which the latter agreed for the payment to be halved at S$5,500 (RM19,149).

Ku then said that Simon helped to pay the amount upfront, which meant that he was indebted to this loan shark again and added that he also sold his insurance plan to pay Simon S$6,400 (RM22,281) including interest.

He added that Tony continued to taunt him for another S$10,000 (RM34,817) as he claimed that Ku had caused his runner to be arrested by the police.

“By then, I had no choice but to inform my boss about the whole incident as the loan sharks had been harassing my workplace daily,” he said.

Ku said he tried to ignore the loan shark’s calls and messages after that and on July 1, someone had left a handwritten note with a threatening message at his house in his hometown, Muar.

He then added that on July 8, someone set fire to the front of his Muar house while his 65-year-old father and 92-year-old grandmother were asleep there.

“My father splashed water on the flames to put it out and my family have been worried about their and their neighbours’ safety ever since,” Ku said, adding that his family also told him not to return to their hometown for the time being.

Ku hoped the loan sharks would stop harassing him and urged the public not to make the mistake of falling for the online moneylenders’ tactics.

“Initially, I only wanted to borrow some money to tide me over. I did not think that I would end up losing my job, my savings and have to stay away from my family. It was a hefty lesson for me,” he added.

Ku said besides lodging police reports in Muar and Johor Baru, he also lodged a police report in the island republic.

Meanwhile, Mok advised the public not to fall for such online loan services as they were mostly unreliable.

“The best way to seek financial assistance is to personally enquire at bank branches, or discuss the matter with your loved ones to avoid unwanted incidents,” he said.

When contacted, a police official confirmed having received the reports and that investigations were underway.

Leave a Reply