Grayscale’s Bitcoin ETF hits $1.6b outflows hours before halving

Grayscale’s spot Bitcoin ETF continued a five-day outflow sprint leading to the halving, a code change that occurs every four years to help maintain BTC scarcity.

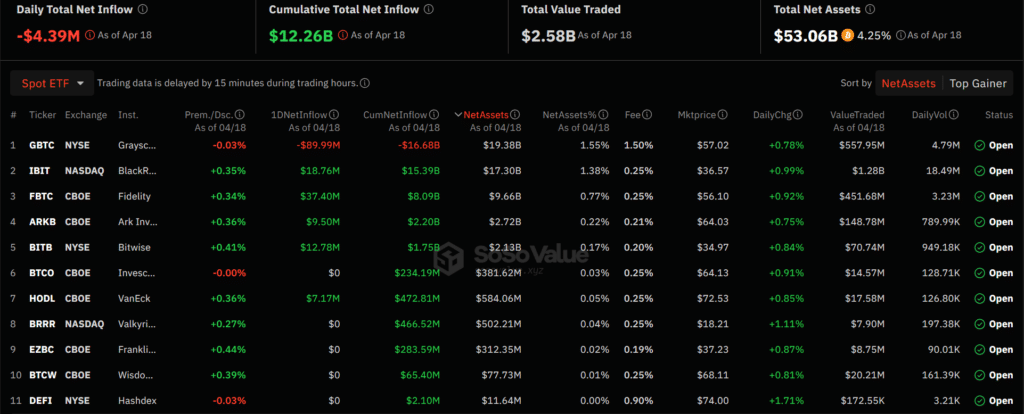

Data gathered by SoSoValue showed $89.9 million in Grayscale exits, bringing GBTC’s total net outflows to $1.6 billion since trading opened back in January.

For all 10 spot Bitcoin (BTC) ETFs, cumulative outflows were recorded as $4.3 million, as Fidelity and BlackRock garnered demand to offset some of GBTC’s liquidations. Fidelity’s FBTC net inflows came in at $37.3 million, outpacing $18.7 million, boasted BlackRock’s IBIT.

April 18 marked a rare occurrence where BlackRock was outclassed by a competitor for inflows in the spot BTC ETF market.

Leave a Reply