Looking for Credit Card? Here are the Best Credit Cards In Malaysia 2019 to apply!

There are so many credit cards in the market but you always get the wrong card? Applying the wrong card not only causing you not enjoying the credit card benefit, some of them even charged expensive annual fee. As a salaried worker, it is kinda sad and sweat too when you received the statement. Actually there are quite many credit cards offer you valuable benefits, let’s check out the best credit cards to apply in 2019!

Disclaimer: The writer wrote this based on his personal research and opinion. The writer do not offer any credit card application.

This article is writing for the groups who have regular spending habits e.g. grocery, petrol and etc and there is no minimum spending requirements.

First of all, you need to check your monthly salary before you apply your credit card. Bank Negara Malaysia limit the credit card applications to public aged 18 and above with monthly salary of RM2,000 and above.

# Annual Salary RM24,000 and above @ Monthly Salary RM2,000 and above

– UOB One Visa Classic –

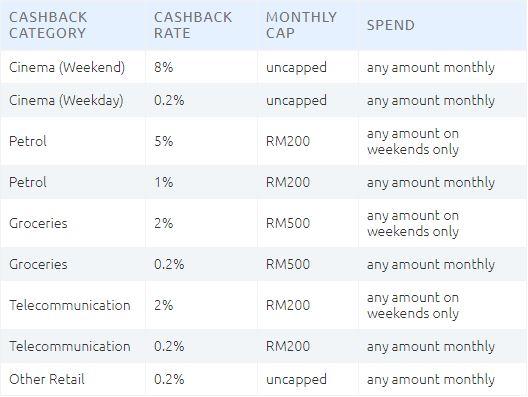

This card offer great rate of cash rebate for few categories inclusive petrol ( 1% / 5% ), groceries ( 0.2% / 2% ), telecommunication ( 0.2% / 2% ), cinema ( 0.2% / 8% ) and other retail spending ( 0.2% ). Cash rebate offered for weekend spending is higher than weekday spending. As a wise consumer, of course we willingly deferred our spending during weekend.

Annual fee charged for this card is RM68 per year. You may try to phone or email to customer service to waive the annual fee if you have swiped the card for particular times or amount in a year.

– Ambank BonusLink Visa Gold –

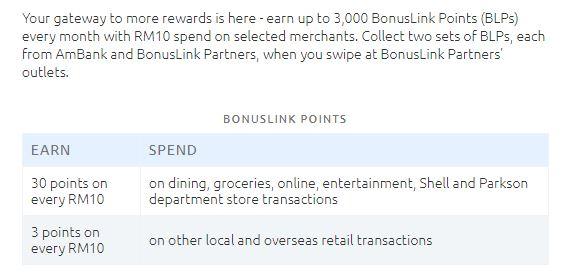

This card is the collaboration of Ambank and BonusLink. Everytime you swipe the card, you can earn BonusLink point which you can use it to redeem rewards. Every RM 10 spending can earn you 30 BonusLink points, maximum 3,000 points in a month.

Annual fee charged for this card is RM225 per year. Fret not! You can enjoy free annual fee for the first 2 years, and subsequently 12 swipes in a year.

– Citibank Clear Visa –

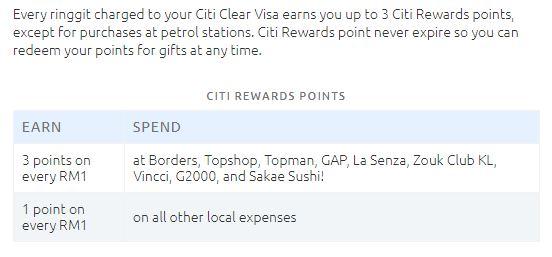

Are you a coffee lover or movie lover? If your answer is a yes, you should not miss out this credit card. With this card, u can enjoy buy 1 free 1 offer at Coffee Bean & Tea Leaf during weekday. You also can enjoy buy 1 free 1 movie ticket at TGV and GSC cinemas every Friday. You can collect 3x rewards points for your spending at certain shops such as Borders, Topshop, Topman, GAP, La Senza, Zuok Club KL, Vincci, G2000 and Sakae Sushi.

Annual fee charged for this card is RM90 per year. New applicants can enjoy free annual fee for the first 3 years when you swipe within 60 days since approval.

# Annual Salary RM30,000 and above @ Monthly Salary RM2,500 and above

– Maybank 2 Gold Cards –

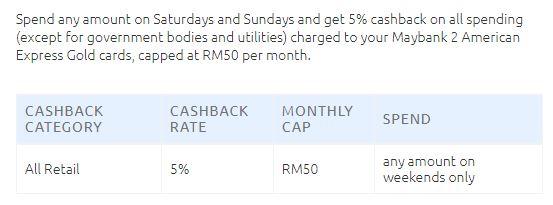

You can get 2 credit cards when you apply for Maybank 2 Gold Cards. They are AMEX and Visa or Mastercard respectively, both of the cards share the spending limit. You can earn Maybank TreatsPoints by spending using either AMEX (5x points) or Visa / Mastercard (1x point). Aside TreatsPoints, you can also enjoy 5% cash rebate on spending during weekend.

Good news to whoever interested are this cards are annual fee free. You no need to pay for annual fee.

# Annual Salary RM36,000 and above @ Monthly Salary RM3,000 and above

– Public Bank Quantum Card –

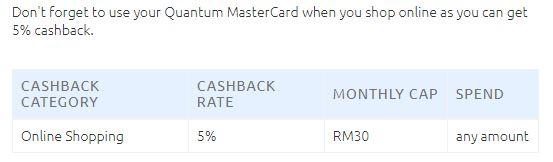

We highly recommend you to apply for this quantum card. You can get two credit cards which are Visa and Mastercard. Cash rebate lovers should not miss out them because you can enjoy 5% cash rebate for both cards. Cash rebate for Mastercard limit to online transaction or spending, maximum rebate RM 30 per month while cash rebate for Visa limit to minimum RM30 paywave transaction, maximum rebate RM30 per month. If you do the calculation, you can find out that you can earn a total of RM60 cash rebate in a month.

Most important thing is this card is free annual fee credit card. We don’t see any reason to not to apply for this card.

Choose credit card based on your spending habit, so that you can make full use of the credit cards. Save and Earn!

Photos credit to the owner.

Comment (1)

you’re really a just right webmaster. The site loading

speed is amazing. It sort of feels that you’re doing any unique trick.

Moreover, The contents are masterwork. you’ve done a excellent process in this subject!